a

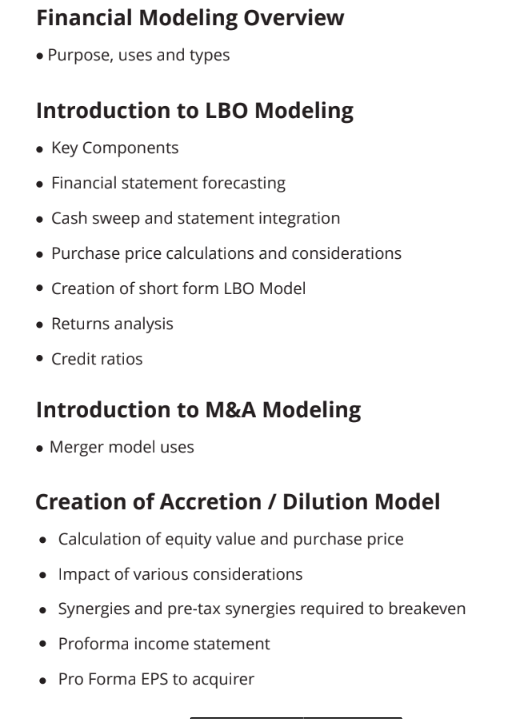

Financial modeling is a departure point from valuation in that it helps to provide us with predicative assessment of what our target company would look like under particular transaction. Modeling is a crucial step in making informed investment decisions that can have a huge financial impact on companies. By attending this course, you will be able to effectively prepare, analyze and interpret financial models in corporate finance and mergers and acquisitions.

• Gain an introductory understanding of integrated financial statement modeling

• Learn to how to forecast projections

• Become familiar with cash sweep modeling

• Acquire the ability to prepare, analyze and interpret financial models

• Construct forecasted financial statement models and perform sensitivity analysis

• Develop or improve Excel skills while learning different modeling techniques

• The mix of basic valuation techniques & applications provided in this seminar will

appeal to a widely diverse audience.

• Equity research analysts, who are interested in examining alternatives to the

multiples that they use or the linkage to discounted cash flow models

• Corporate financial officers, who want to understand the details of valuation,

either because they are planning acquisitions or are interested in value

enhancement strategies for their firms

• Analysts involved in mergers and acquisitions, who would like to acquire a wider

repertoire of valuation skills

• Portfolio Managers who are interested in the effects of corporate restructuring

on firm value, and the implications for portfolio management.

• Anyone interested in valuation

a